Web3 evolving rapidly in 2026. First, real world asset (RWA) tokenization bridging the gap between physical asset & blockchain. Next, Decentralized Physical Infrastructure Networks (DePINs) gaining traction, transforming how decentralized networks operate. Then, these innovations shaping new financial, technological & social landscapes. Together, RWA tokenization & DePINs promise a more connected, transparent & efficient Web3 ecosystem.

What Is RWA Tokenization?

RWA tokenization mean converting physical asset into digital tokens on a blockchain. First, assets like real estate, commodities or fine art are digitized. Next, these tokens represent ownership, rights or fractional shares. Then, they be trade or use in decentralized finance (DeFi) applications.

The benefits include:

- Fractional ownership for broader access

- Increased liquidity for previously illiquid assets

- Transparent and immutable records on blockchain

Because of these features, tokenization is democratizing access to high value assets & creating new financial opportunities.

Why RWA Tokenization Matters in 2026

RWA tokenization matter more than ever. First, traditional asset markets are slow, expensive & opaque. Next, blockchain allows instant settlement & global access. Then, investors gain real time transparency.

Moreover, tokenization reduce intermediaries. Additionally, it integrate assets into DeFi protocols, allowing user to leverage assets for lending, staking or trading. Consequently, tokenized asset are opening new investment avenues while aligning with Web3 principles.

How DePIN Is Transforming Infrastructure

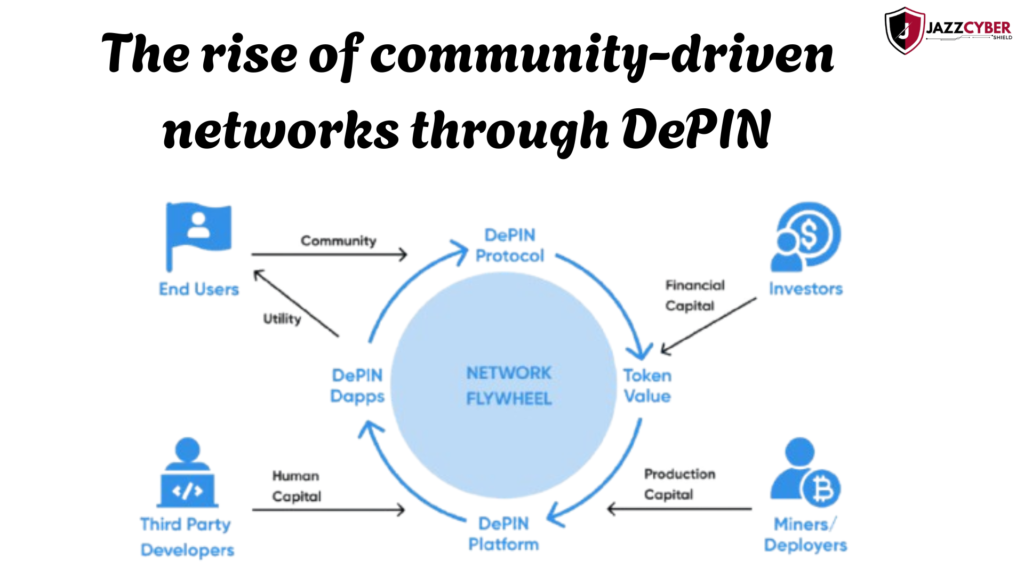

DePIN or Decentralized Physical Infrastructure Networks, refers to distributed networks powered by community participants rather than central operators. First, nodes contribute physical resources such as energy, bandwidth or IoT devices. Next, these nodes earn reward for participation. Then, network become more resilient, scalable & censorship resistant.

DePINs are growing in sectors like:

- Wireless networks & mesh internet

- Renewable energy grids

- IoT & smart city infrastructure

- Autonomous delivery & logistics networks

Because DePIN leverages decentralized participation, networks become more secure, transparent & efficient than traditional centralized systems.

The Connection Between RWA Tokenization & DePIN

RWA tokenization & DePIN are complementary. First, tokenized physical assets fund DePIN projects. Next, DePIN networks generate revenue streams that are tokenized for investors. Then, this creates a self sustaining Web3 ecosystem.

For example:

- A tokenized solar farm funds a decentralized energy grid.

- Community nodes provide connectivity, earning tokenized rewards.

- Investor trade fractional owner-ship of these asset on block-chain platforms.

Thus, both concepts accelerate adoption, create liquidity & align financial incentive with decentralized governance.

Financial Opportunities with Tokenized RWAs

Investors gain access to real world assets previously reserved for institutions. First, RWA tokenization allows fractional investing. Next, DeFi protocols enable lending & borrowing against tokenized assets. Then, tokens generate yield in decentralized marketplaces.

Benefits for investors include:

- Access to diverse assets

- Enhanced liquidity

- Transparent, real time performance data

- Integration with DeFi platforms

Consequently, RWA tokenization democratizes wealth creation while maintaining alignment with Web3 principles.

DePIN & the Rise of Community Powered Networks

DePIN networks rely on community participation. First, nodes contribute bandwidth, energy or storage. Next, they earn token rewards, incentivizing long term engagement. Then, this approach reduce reliance on centralized providers.

Key advantages of DePINs include:

- Increased resilience through decentralization

- Transparency in operations

- Reduced risk of censorship or control by single entities

- Community driven governance

As a result, DePINs are expanding the capabilities of decentralized networks beyond software, bringing physical infrastructure into Web3.

Security & Transparency Considerations

Security is critical in tokenized RWAs and DePINs. First, smart contracts enforce rules automatically. Next, blockchain ensure data cannot be tampered with. Then, transparency allows stakeholders to verify network operations & ownership.

Moreover, tokenized RWAs reduce the risk of fraud by providing verifiable ownership records. Additionally, DePIN network protect against centralized failures. Together, these system provide strong safeguards for investors & users alike.

Use Cases Across Industries

RWA tokenization & DePIN adoption are accelerating across multiple sectors.

Example include:

- Real estate: Fractional owner-ship of commercial or residential properties

- Energy: Tokenized renew-able energy supporting decentralized grid

- Telecom: Community owned mesh networks offering decentralized connectivity

- Logistic: Autonomous delivery network supported by tokenized infrastructure

These use case show how Web3 technologies bridge gap between digital & physical worlds, creating practical applications with real impact.

Challenges to Adoption

Despite their potential, RWA tokenization & DePINs face challenges. First, legal & regulatory frameworks vary by country. Next, technology standards for interoperability are still evolving. Then, on boarding user to new financial models requires education.

Additional challenges include:

- Asset valuation for tokenization

- Node maintenance & reliability in DePINs

- Network scalability

- Trust & security considerations for investor

Nevertheless, industry innovation, standardization effort & regulatory clarity are steadily overcoming these hurdles.

The Role of Jazz Cyber Shield

Jazz Cyber Shield monitors innovations like RWA tokenization & DePIN because these systems redefine digital & physical security in Web3. By providing guidance on secure smart contract deployment, tokenized asset management & decentralized network security, Jazz Cyber Shield help businesses & investors navigate the evolving Web3 landscape safely.

The Future of Web3 Finance & Infrastructure

Web3’s next chapter blends tokenized assets & decentralized networks. First, RWAs provide financial depth & liquidity. Next, DePIN ensure infrastructure is community powered & resilient. Then, combined, they create a decentralized, transparent & scalable ecosystem.

Future trends include:

- Integration of AI & IoT in DePIN networks

- Real-time trading of tokenized physical assets

- Cross-chain interoperability for RWAs

- Enhanced governance & compliance tools

These trends suggest that Web3 will not only disrupt finance but also the physical infrastructure powering the internet & society.

Conclusion

RWA tokenization & DePIN represent the next phase of Web3 innovation. First, tokenizing real world assets democratizes access to investments. Next, DePIN networks decentralize physical infrastructure & empower communities. Then, together, they enhance transparency, security & financial opportunity.

In 2026, adopting these technologies is no longer optional for forward looking investors & network participants. As Web3 matures, RWA tokenization & DePIN will define the future of finance, infrastructure & digital identity.

This blog offers a clear and forward-thinking perspective on the future of Web3. The explanation of RWA tokenization is easy to understand, even for readers new to the concept. I especially liked how DePIN was linked to real-world use cases. A very insightful and educational read overall.

An excellent and well-researched article. The way RWA tokenization and DePIN are explained together makes the future direction of Web3 much clearer. The content is informative without being overly technical. Definitely a valuable read for anyone interested in blockchain innovation.

What a well-researched and thoughtful blog! I found the breakdown of real-world asset tokenization incredibly helpful, especially when connected to the emerging DePIN ecosystem. The writing strikes a great balance between technical depth and readability, making it useful for both beginners and experienced readers. Definitely a valuable resource on Web3 developments.