Advanced Micro Devices (AMD) is one of the most watched semiconductor stock heading into 2026. As investor seek high growth tech plays, AMD stands out because of its expanding role in AI chip, data center & server CPUs. This guide provide a detail advance micro devices 2026 guide, including AMD stock 2026 forecast, AMD 2026 growth outlook & investment strategy 2026, helping investor understand future opportunities & risk.

Why AMD matter in 2026

AMD has transformed from a PC processor maker into a data center and AI computing powerhouse. With enterprise demand rising for faster computing and AI deployments, AMD’s chips are now essential infrastructure. Investors ask: Is AMD stock a good buy in 2026? and What will drive AMD future growth 2026? This guide answer those questions with insight on AMD 2026 analyst prediction, AMD 2026 earnings outlook & practical AMD 2026 investment tips for long term investor.

AMD at a Glance:

Advanced Micro Devices compete with NVIDIA & Intel across CPUs, GPUs & AI accelerator. AMD’s stock surged in recent years due to strong demand in data center & AI. Its AMD AI chip stock 2026 prospects are promising, and AMD data center growth 2026 is a major contributor to its revenue expansion. For investor seeking AMD long term stock outlook 2026, this is an important trend to watch.

Historical stock performance and competitive landscape

AMD stock shown strong growth, reflecting its technological advances & market share gains. The AMD stock 2026 forecast highlight steady revenue increase, especially in AI & server CPUs. However, short term volatility remain due to macro-economic factor & competition. Analyst tracking AMD stock risks 2026 note pressure from NVIDIA and other semiconductor player, but AMD growth driver 2026 suggest continued upside.

2026 Growth Drivers: AI, Data Centers, and Cloud Demand

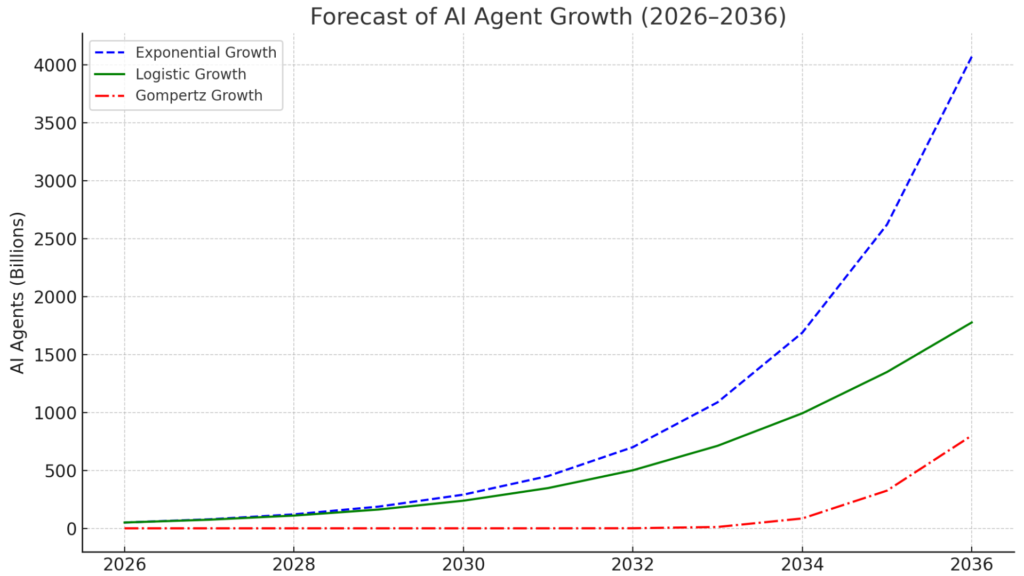

AI and Accelerators

AI adoption is the biggest catalyst for AMD AI chip stock 2026. As companies deploy large language models & AI workload, AMD’s EPYC AI growth 2026 initiative strengthen its market position. Partnerships with AI developer boost both revenue & credibility. Investor looking to invest in AMD 2026 should consider the AI segment as a primary driver of value.

Data Center Expansion

Demand for cloud computing fuel AMD data center growth 2026, making it one of the fastest expanding revenue segment. Analyst include this segment in the AMD 2026 growth outlook when predicting future earning. For long-term holders, this represents a significant part of AMD future growth 2026.

Partnerships and Product Roadmap

Strategic collaborations and a robust product pipeline—including next-generation CPUs and AI accelerators—support AMD’s AMD 2026 investment strategy. These initiatives also reinforce AMD stock valuation 2026 and guide expectations for AMD stock price target 2026.

Analyst Forecasts and Price Targets

Wall Street analysts maintain a positive view of AMD stock 2026 forecast. Key points include:

- Price target indicate strong upside, supporting AMD stock price target 2026 expectation.

- AMD 2026 analyst predictions suggest that earning growth & market share gain could drive stock performance.

- Long term trend in AI & cloud computing align with AMD AI revenue growth 2026.

Investor following AMD long term stock outlook 2026 use these insight to evaluate risk and opportunity.

Financial Health and Future Growth Rates

The AMD 2026 earning outlook is strong. Revenue & EPS are expected to rise steadily due to demand in AI, cloud & gaming sector. AMD EPYC AI growth 2026 & AMD data center growth 2026 will be major contributor to overall revenue. For those looking for AMD 2026 investment tip, focusing on these growth areas yield higher return.

Competitive Risk & Challenges

Even with positive forecast, investor should consider AMD stock risks 2026:

- Competition: NVIDIA lead high end AI accelerator. AMD innovate to increase market share.

- Revenue guidance: Short term revenue projection fluctuate.

- Global issue: Geopolitical tension affect semiconductor access.

These risk are key for anyone planning to invest in AMD 2026.

Investment consideration for 2026

Long Term vs Short Term Strategy

For those focused on long term growth, AMD’s AI & data center initiative provide solid opportunities. The AMD 2026 growth outlook support this view. Short term volatility mean careful planning is necessary.

Portfolio Role

Adding AMD to a diversified tech portfolio align with AMD 2026 investment strategy & help balance exposure to high growth semiconductor trend. AMD stock valuation 2026 suggest favorable entry points for long term investor.

Conclusion:

AMD’s outlook for 2026 is shaped by AI adoption, data center growth & strong revenue forecasts. While competition and short term fluctuation exist, AMD future growth 2026 looks promising. For investor seeking actionable insight, this advanced micro devices 2026 guide highlights key trends, risks & opportunities, making AMD a compelling stock to watch.

5 FAQs

1. What is AMD stock 2026 forecast?

The forecast suggest steady growth due to AI & data center expansion, making it a strong option for long term investor.

2. How I use AMD 2026 investment tip effectively?

Focus on high growth segment like AI chip, server CPUs & cloud partnerships to maximize returns.

3. What are AMD 2026 analyst prediction?

Analysts expect double digit revenue growth & increasing market share, supported by AI & cloud adoption.

4. Is AMD AI chip stock 2026 good buy?

Yes, due to increasing demand for AI hardware, AMD’s AI accelerators are a key growth driver.

5. What are the main AMD stock risks 2026?

Risks include strong competition, short-term revenue fluctuations, and global trade issues impacting semiconductors.